When it comes to sending money internationally, traditional banking transfers have long been a popular method. Many people still rely on their local bank branches to initiate wire transfers or send funds via international checks. These methods offer a sense of security and familiarity for those who prefer the traditional approach.

One example of a traditional banking transfer service is HSBC Global Transfers. HSBC allows customers to send money between their own accounts in different countries, making it convenient for individuals with global financial needs. Another option is Citibank’s Global Transfer service, which enables customers to easily transfer funds between Citibank accounts worldwide.

However, receiving money from wires takes up to 5 working days in some countries. This makes it impossible to exchange currencies using traditional wires and get instant payment. If this is what you are trying to do, or you are trying to send money instantly to loved ones, this may not be ideal for you.

So, you’re looking for a blue pill that solves this problem? What then are the best ways to send money internationally? How does Palremit fit into your cross-border transfer needs? Let’s dive into the world of payments!

Online Money Transfer Services

Online banking transfers have gained significant popularity as a convenient way to send money internationally. They allow users to initiate transfers from the comfort of their homes or offices without having to visit physical branches.

An example of an online banking transfer service is TransferWise (now Wise), touted as one of the best. It offers competitive exchange rates and low fees for international money transfers.

Pros:

- Wise is considered one of the best options for money transfer services

- No hidden fees

- Intuitive app design

- Large number of pay-in options

- Up to 57 currencies and payments in over 80 countries supported

Cons:

- Limited cash pick-up options

- Transfers typically take 1 – 2 days and as much as 2 – 3 days in some locations

- Wise is not cheap to use if you are outside North America or Europe

Digital Wallets & P2P Apps

Digital wallets and peer-to-peer (P2P) apps have revolutionized the way we handle our finances, including sending money internationally. These mobile applications provide instant access to funds and simplify the process of transferring money across borders.

Venmo is one such digital wallet app that has gained popularity among millennials in the United States due to its user-friendly interface and social features.

Pros:

- Venmo is fast and easy to use

- Popular among millennials to send money to family and friends

Cons:

- Venmo charges a fee for using credit card to send money

- Notorious platform for nefarious people carrying out fraudulent activities.

- Limited features

Prepaid Debit Cards

For individuals who prefer more control over their spending while sending money abroad, prepaid debit cards can be an excellent option. These cards are often reloadable and can be used globally wherever major card networks are accepted.

One example of a prepaid debit card service is Revolut. Revolut offers multi-currency accounts with competitive exchange rates and the ability to spend in over 150 currencies.

Pros of Revolut:

- Wide range of currencies supported

- Best for card transfers

- Low fees

Cons:

- Takes up to 2 business days

- Limited cash pick-up options

- Users have complained of poor customer support

MoneyGram and Western Union

MoneyGram and Western Union are yet more options users can make for their international money transfer needs. MoneyGram offers services like bill payment, cash pick-up, bank deposits, mobile wallet deposit, travel orders, and official checks.

MoneyGram is popular for its convenience. It has a large network of agent locations, so it is easy to find a place to send and receive money. It also provides a reliable service, and you can be certain that your money will get delivered. But the downside to using a service like MoneyGram is its high charge fees and slow cash delivery. Customes have complained of the exorbitant fees and slow transfer times.

And you’d think Western Union fares any better. But on the flip side, it’s just the same story. But customers deserve better. We’re currently building the solution to all your financial problems in one app. Don’t take out word for it, here’s how we are doing this.

How Palremit Competes

Palremit is a Cross-Border P2P payments enablement platform that allows senders and receivers to transact conveniently. With our platform, we bring you closer to achieving all your financial goals.

Palremit lets you:

- Spend anywhere with your physical and virtual debit card

- Exchange currencies with ease when you travel abroad

- Send money back home to your loved through peer-to-peer transfers when you both install the app

- Pay your bills and shop your favourite stores online

- Buy digital currencies from p2p vendors on the platform and exchange fiat money for your purchases

- Deposit into your mobile wallet and do more with it

- Access mobile money and send cash to your Mpesa account

Security Is In Our DNA

Palremit wouldn’t be Palremit without its focus on security.

Our philosophy is safety first, and safety next. We have also built our focus on delivering a strong, supportive customer support service. Because we believe that for any fintech with a purpose as heavy as ours, we have to be there for the most important people to us—you.

Our application was developed by a team of talented engineers utilizing cutting-edge blockchain technology to facilitate faster payments and transactions.

Competitive Rates

We cannot say we are not the change we believe in when we do nothing to make it happen. For many years, many users have been ripped off their hard-earned money by transfer service providers and couriers to process cross-border payments.

Without efficient methods and alternate means for payments, people have succumbed to funding at high rates and high fees. We aim to correct this. Palremit provides low, competitive rates for our customers to exchange different currencies, buy digital securities and spend anywhere.

We Verify Your Account Against Fraud

Upon creating an account on Palremit, we ask users to verify their accounts to ensure protection against hacks and user information theft. We also provide enablements for our users to perform KYC verifications and identity confirmation to ensure data confidentiality.

We are Registered

Palremit partners with trusted fintech and financial organizations to solve the financial needs of Africans and expatriates on international remittance. We are fully registered and follow the specific rules of regulatories in the countries we operate.

We Have a Solid Structure in Place

We aim to solve international remittance and currency exchange problems for African expatriates all over the world. We are building our services to give access to these users to do more with their finances from wherever they are. We are building our services to operate in over 150 countries where users can spend money, receive money (p2p), and pay bills with ease.

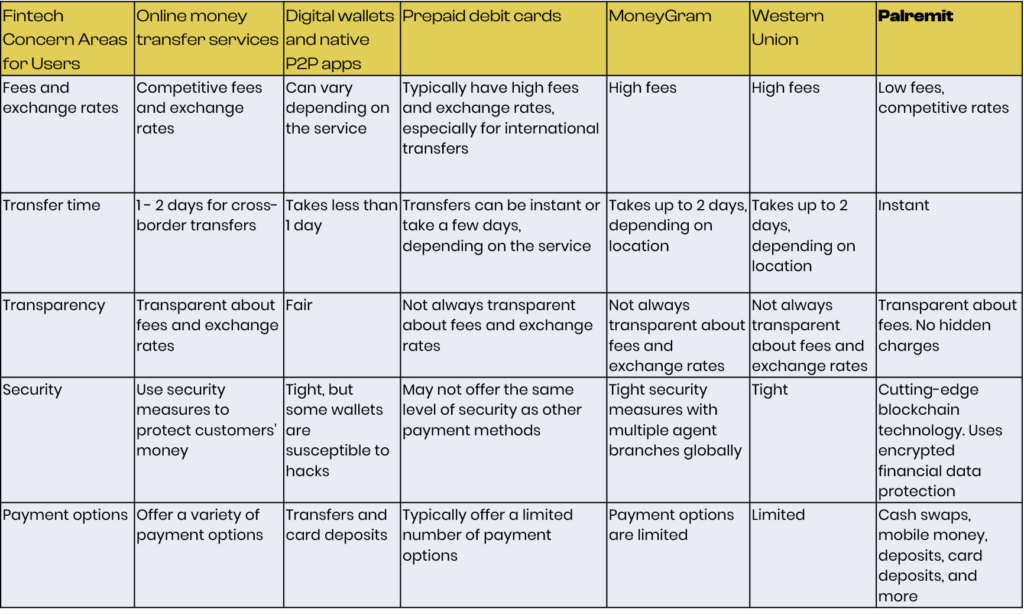

Send Money Efficiently, No More Lies

We compared Palremit against other established platforms to see how we performed.

Palremit benefits

Focus groups:

- Online money transfer services: Wise, Remitly, WorldRemit

- Digital wallet and P2P apps: PayPal, Venmo, Cash App

- Prepaid debit cards: Netspend, Green Dot, American Express Serve

- MoneyGram and Western Union

- Palremit

Spend With Ease

Palremit is on a mission to simplify payments and make it easier for expatriates and nomad traders to send money and exchange money and digital securities

Download the Palremit app on Google PlayStore or Apple Store to enjoy seamless financial transactions on the go. The app now allows you to swap money between USDT and other local currencies, so you can start using your money without borders.