Latest Posts

The Hidden Link Between Financial Access and Health Outcomes

Discover how access to digital finance tools like remittances, savings, and mobile wallets is shaping global health outcomes..

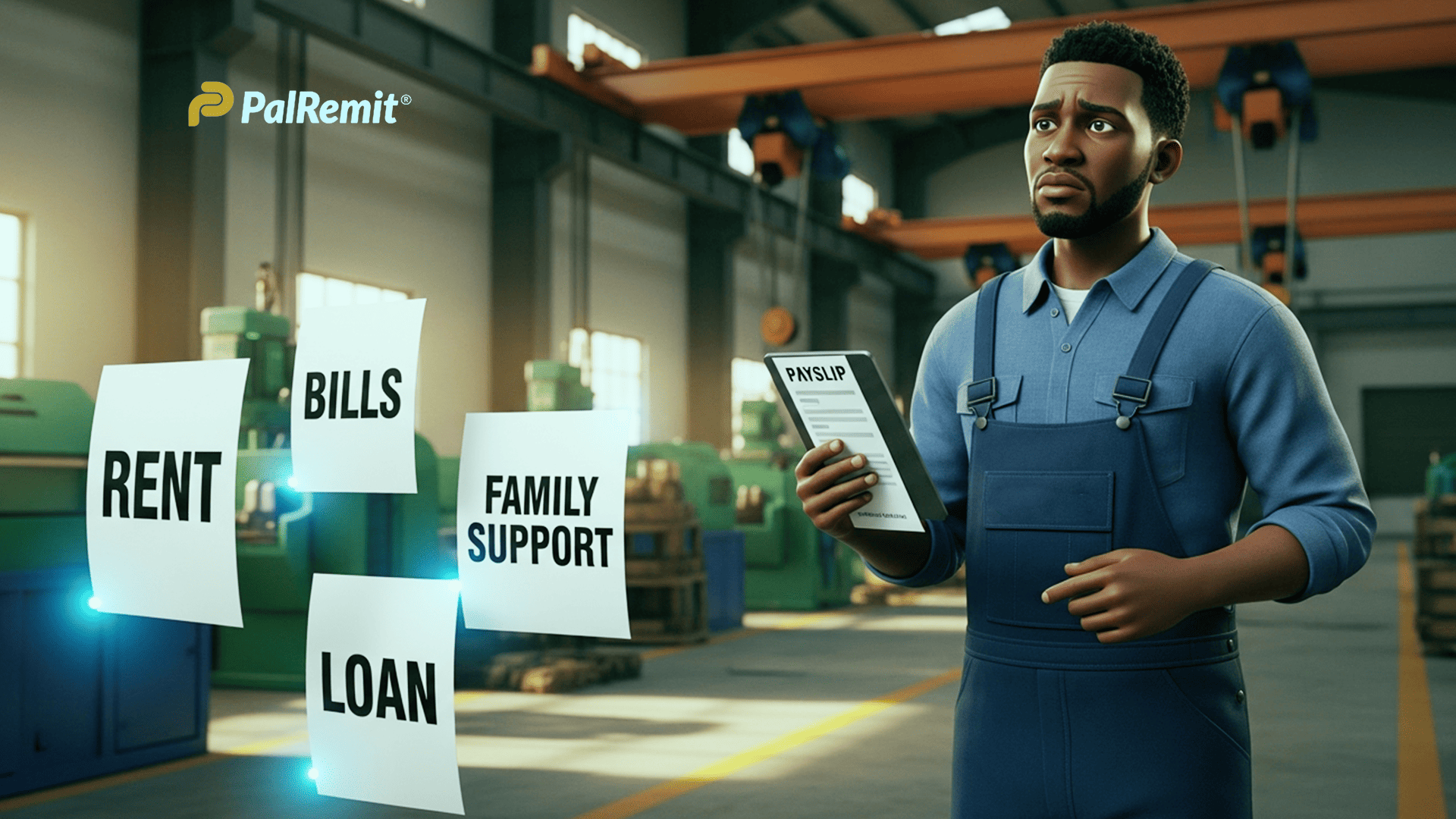

Why Many Africans Abroad Still Struggle Financially (Even When They Earn Enough)

Explore why many Africans abroad still struggle financially, even with good incomes, and uncover the hidden costs of life in the diaspora.

How African Content Creators Can Get Paid in USD Without a U.S. Address

Discover how African content creators can receive USD payouts directly through virtual accounts like Palremit—no U.S. bank account or address required.

How to Build a Resilient Emergency Fund

Learn how to create and protect an emergency fund that shields you from financial shocks, inflation, and unexpected crises.

KYC Not Approved? 5 Common Issues and How to Fix Them

Find out why your KYC might not be approved on Palremit and learn the steps you can take to resolve issues quickly and start transacting without delays.

How to Secure Your Money During a Currency Crisis

Discover practical ways to protect your savings during a currency crisis, from diversifying holdings to using digital USD accounts on Palremit.