Payments come in different forms. It can start simple, like exchanging one item of equal value for another. Or, like in today’s world, it can exist as a central idea where people all agree that a certain currency will hold the value for everything we buy.

Yet, when it comes to cross-border payments, it’s a whole different beast.

Years ago, if you were in Nigeria and wanted to send money to your friend in Ghana, you only had two options: send through wires that were painfully slow, or use the Hawala system where money changed hands before it got to your friend—it carried so much risk.

Another option—that really wasn’t an option—was to physically move the cash there yourself. So, your friend had to wait until you booked your next bus or flight ticket to come and give them their money. Hopefully, they’re that generous with their patience.

Although fintech development in the last ten years has been opening up businesses and allowing digital commerce to thrive in Africa, cross-border payments have always been the scourge of the industry.

Money laundering, undercover money, hidden transactions—all these things make cross-border payments very hard. Doing finance is already a constant pain you cannot make go away by blowing it off.

Yet, remittance platforms like Palremit are bucking the trend, setting the pace for how people access their money across borders.

With our app, you can open a virtual US dollar (USD) account that works like a proper bank account for you. You can receive and move USD anyhow you like.

However, technology and enablement like this does not exist without its many downsides. We are peeling back the layer on how we handle operations for our USD remittance service.

You Can Open a USD Account on Palremit

Opening a USD account on Palremit is simple and quick.

All you need to do is provide some essential information, which includes your full name, email address, and a valid form of identification (ID) for verification purposes.

To get started:

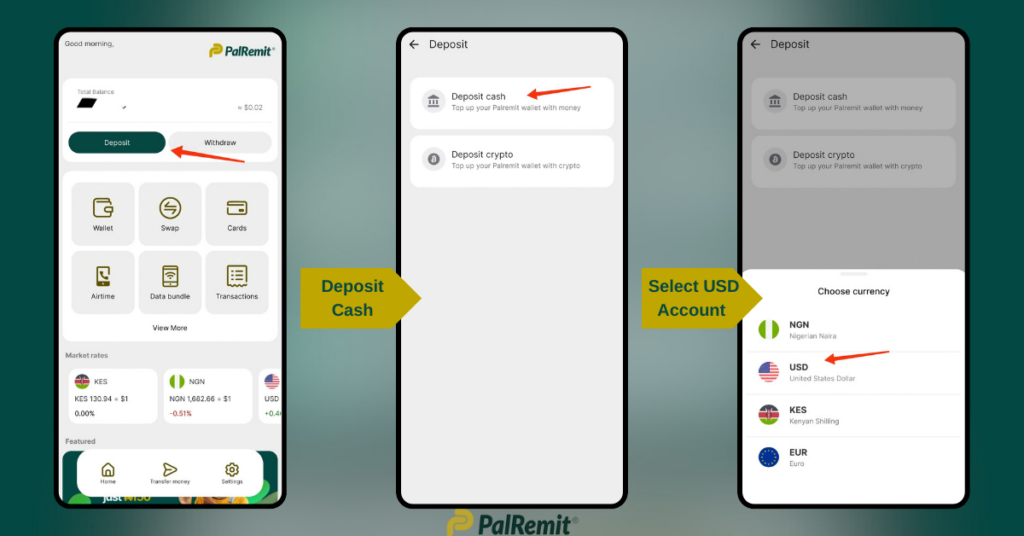

- Open your mobile app and select Deposit

- Then select Deposit Cash

- A pop-up shows on your screen asking you to choose a currency (to deposit money into); select USD

Now, if you have already created a virtual USD account, you will see your bank details next.

However, if you haven’t, the app will immediately take you to a screen where you can start filling your details to request a USD account.

Please note that you must have completed Know Your Customer (KYC) verification before you can continue.

Next, you will provide:

- Your full name and residential address

- A means of identification like your National Identity Card or a passport

- A photo of your last utility bill (preferably not older than three months); this will help us check that the name you supply us with and match the address on your utility bill

You will also answer a few questions about:

- Your occupation

- Your transaction range (this can be the amount in USD you transact monthly, this doesn’t limit how much you receive beyond our standard amount)

- What you will use the USD account for (salary, payments, saving, investing, etc)

- If you will be the sole controller of your USD account (that is, you are creating it for your own personal use)

Asking these questions and getting these details helps us ensure that we meet compliance regulations and maintain the security of your account.

With this information, we can protect your money better and flag suspicious activities when we detect them on your account.

Creating a USD account only takes a few minutes. Once you’re verified, you will receive a notification confirming your account creation.

You can start receiving funds and transacting in USD, opening doors to international payments.

I Have a Palremit USD Account, So What?

With your virtual USD account, you can receive USD payments from anywhere in the world, provided that the transfer system allows it.

That includes: as a freelancer, you can get paid in dollars ($) for your work through payment providers like Wise, Stripe, Payoneer, gig platforms like Upwork, or any other platform that allows deposits directly to bank accounts.

As a business owner, you can make payroll in dollars to your staff using Palremit; quick and easy to set up.

Can you send USD with your virtual account?

The answer to this is yes and no. But first, what is the “yes”?

Yes, because once you receive money in dollars from wherever, you can convert it to any other currency you like, including Nigerian Naira (₦), European Euro (€), Kenyan Shillings, or cryptocurrencies and stablecoins like USDT—using Palremit.

Palremit is a multi-currency wallet that allows you to swap fiat and crypto easily.

Currently, our app does not enable direct fiat-to-fiat swaps, but you can swap your dollars to crypto, and convert to another fiat currency.

Also, with your money in USDT, you can send stablecoins to your friends, family, or employees through Palremit peer-to-peer (P2P) transactions.

Then, it’s a “no” because you cannot directly send USD from your virtual account on Palremit. This is a work in progress. Once we ship the feature, we will update our users.

How We Operate—Our Terms

Facilitating cross-border payments in fintech is like running the proverbial bull in a china shop. You can break things, piss off a few users, or get on the wrong side of the law.

Yet, we want to maintain a balance. To do that, we follow some rules and frameworks for how we operate, as well as how we perform our due diligence.

Creating a Palremit USD account is free and it costs nothing to withdraw dollars from your account. Palremit currently does not charge you any fee for maintenance or USD deposits. However, deleting your created USD account from our records will cost $5.

The first point is your USD account is managed by you. This means that, at all times, when we fact-check transactions that come into your USD account, they must be in your name.

You can receive USD from anyone: family, business employers/clients, or via automated clearing house (ACH) transactions.

The daily transaction limit for all these USD transactions is $50,000—but this figure is hyphenated, as the limit and terms can differ based on the different sets of people that send you money.

Here’s the breakdown:

- If you are receiving money from a family member bearing the same last name as you (and we can confirm this by matching your last name with theirs), there are no limits; only our daily limits apply.

- If the money comes from third parties, the limit is $4,000 per transaction. You can send this amount only up to 5 times (to make up $20,000) daily.

- There are no limits if you are receiving payment from your business employer or client for whom you rendered a service. However, we carry out enhanced due diligence (EDD) for all high-value transactions. Please see this breakdown in the next section.

- There are no limits for international ACH transactions (IATs), but transfers from traditional wires like MoneyGram and Western Union have a $2,000 limit per transaction.

Palremit also supports peer-to-peer (P2P) deposits, making it easy for users to claim funds from different banks.

There is a $4,000 limit per transaction, after which you can then transact higher volumes. In the case of P2P deposits like this, you can receive up to $50,000 in a month.

This gives users even more flexibility to move their money effortlessly across borders.

Here are other information you must know as you operate your USD account with us:

- Minimum Deposit amount per transaction ➡ $20

- Minimum Withdrawal amount per transaction ➡ $20

- Maximum Withdrawal amount daily ➡ $7,000

- Maximum Withdrawal amount monthly ➡ $200,000

- Maximum Deposit amount monthly ➡ $200,000

- The card deposit charge is 1% for Palremit USD cards

Enhanced Due Diligence (EDD)

At Palremit, we take extra care when it comes to large or unusual transactions. This is why we perform Enhanced Due Diligence (EDD) on accounts that handle high-value payments.

Our EDD process ensures compliance with international regulations and protects both you and our platform from potential risks, such as money laundering.

When your account reaches a certain threshold, we’ll ask for some extra information to verify the source of funds. This includes a brief explanation of where the money is coming from and documents that support the expected monthly payments.

For example, if you’re using your USD account for client payments, we may ask for details like your business partner’s website.

Additionally, you might need to provide statements of funds received over a time period to continue your transaction process.

By following these steps, we make sure your transactions are secure, while also maintaining a smooth experience for you.

Our goal is to protect your money and ensure that Palremit remains a trusted platform for cross-border payments.

Open a USD Account Now

The message is simple: it’s never been easier to move your money across borders.

Download the Palremit app on Google PlayStore or Apple Store to enjoy seamless financial transactions on the go. The app now allows you to swap money between USDT and other local currencies, so you can start using your money without borders.

*Footnote: This article was last updated on October 24, 2024.