Traveling to a new area usually means one thing: you need to blend in. And there’s no better definition of “blending in” than exchanging local money to foreign currency to allow you to spend in your new environment. This is what gives rise to money exchange scams; people try to take advantage of travelers through underhanded means.

Money exchange scams come in various forms, from sleight-of-hand tricks to counterfeit currency and even fake exchange offices. These scams not only put your hard-earned money at risk but can also leave you in a vulnerable position, especially when traveling in an unfamiliar place.

While some scams are easy to spot, others are highly sophisticated and can catch even the most vigilant individuals off guard. Here are 7 money exchange scams we found ridiculous and how first-time travelers, expatriates, or tourists can protect themselves.

#1 Short-Change Trick

Short-changing scams involve deliberately giving you less money than you should receive during a currency exchange transaction. This can be done through various tactics, such as quickly counting the money, using sleight of hand tricks, or distracting you during the exchange process.

A common short-changing tactic is the “confusion method,” where the scammer intentionally fumbles with the money, drops some bills, or engages you in conversation to create confusion, allowing them to shortchange you without you noticing.

#2 Sleight of Hand

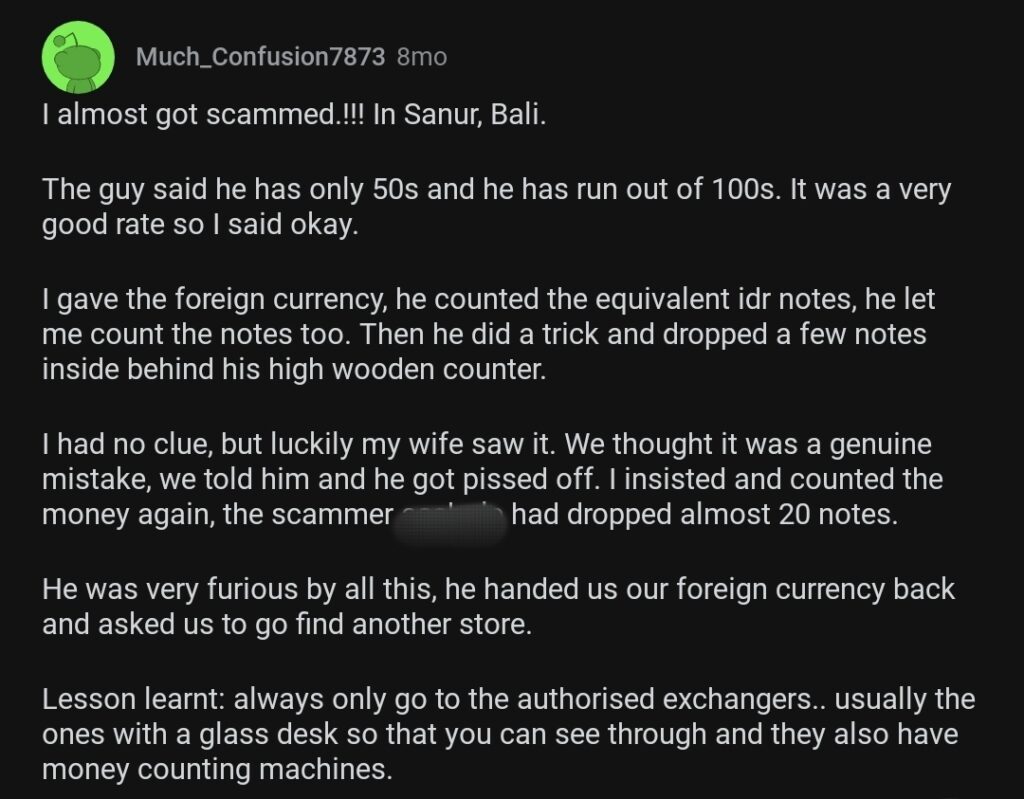

Popular in tourist locations like Bali, Indonesia, the sleight of hand trick has become one of the most notorious money exchange scams. Sleight of hand tricks are deceptive techniques used by scammers to manipulate the exchange process and steal your money. These tricks often involve quick hand movements, misdirection, and distractions to conceal their actions.

For example, a scammer may pretend to drop or miscount the money, then use sleight of hand to palm or conceal some of the bills, giving you less than the agreed-upon amount.

A Redditor once shared a story of how they almost got ripped off when they wanted to exchange currencies in Bali and we think this sums it up.

How to Protect Yourself

Always make sure you are the last person to handle your money (the exchanged currency) before you leave that place, no matter what.

Secondly, watch them closely when they handle your money. If you spot any foul play, politely call their attention to it.

#3 Rigged Counting Machines

Some unscrupulous exchange offices use rigged or tampered counting machines to shortchange customers. The machines are pre-programmed to miscalculate and under-count the amount of currency being exchanged, resulting in you receiving less money than you should.

How to Protect Yourself

To avoid this, always re-count the exchanged money yourself before leaving. Don’t rely solely on the machine’s displayed total.

#4 Fake or Counterfeit Bills

Counterfeit currency scams involve exchanging genuine money for fake or counterfeit bills. These counterfeit bills may look authentic at first glance but are worthless.

How to spot counterfeit bills

Carefully inspect the paper quality, watermarks, security threads, and other anti-counterfeiting features. Research the specific security features of the currency you’re exchanging to spot fakes more easily.

#5 Taxi Scam

Another less-popular scam trick is the airport taxi scam. It’s a ridiculous trick to get you to pay more than what was agreed.

Here, when you pay for your taxi rides with currency bills you’ve just exchanged, the driver pretends to “not have change” on them. So, they step out to find some. When they come back, they begin to accuse you of trying to con them with fake bills. And yes, you guessed right. They exchange your legitimate currency bills with fake bills so they can extort you some more, or threaten to report you to the authorities if you refuse to comply.

How to Protect Yourself

Aside from money changers, you should equally be wary of taxi drivers when you travel. We advise taking photos of the serial number on your currency bills after you’ve exchanged them. This way, it is easy to verify them in case of foul claims from these taxi drivers who want to rip you off.

#6 Back-Alley Exchange Offices

Back-Alley or illegal exchanges exist almost everywhere you go when you travel — shady people at the airports, train stations, and tourist areas may try to lure you with attractive exchange rates.

However, these unlicensed and unregulated operations are often fronts for various scams, including shortchanging, counterfeit currency, or simply taking your money without providing any exchange.

How to Protect Yourself

We advise that you look for authorized money changers when you travel. And never fall prey to money couriers practicing underhanded tactics, no matter how good their deal may seem.

#7 Exchange Rate Manipulation

This scam involves offering an attractive exchange rate initially, but then manipulating the rate during the transaction, resulting in you receiving less money than expected.

How to Protect Yourself

Always be aware of the current exchange rates and be wary of rates that seem significantly higher or lower than the market rate. Double-check the calculations and ensure the final amount you receive matches the agreed-upon rate.

The Best Places to Exchange Your Local Currency When You Travel

The next time you travel and need to exchange your local currency with foreign money, these are Palremit’s top three recommendations.

#1 Banks

Granted, banks may charge higher fees for currency exchange services, but they are generally a more secure and trustworthy option, especially for larger amounts.

#2 Local ATMs

Alternatively, travelers have found local ATMs to be a reliable means of exchanging money. By withdrawing cash from an ATM, you can avoid potential scams and get the best available exchange rate.

Here’s how this works: You can exchange your local currency to your desired foreign currency on exchange apps and digital wallets. This eliminates the need for money couriers or exchange offices when you travel. With your foreign card, you can then withdraw from any ATM when you travel.

Palremit is a credible exchange platform offering the best exchange rates for supported currencies on our platform. And with our hybrid cards coming soon, you can withdraw at local ATMs in over 150 countries.

#3 Verified Money Changers

Look for well-established money changers with proper licensing and accreditation, preferably located in reputable establishments like major hotels or shopping centers.

Don’t let money exchange scams ruin your travel experience. Stay alert, use trusted services like banks, online money exchange services, and verified money changers when next you’re planning for your travel, and prioritize your safety. A little caution goes a long way in protecting your cash from currency exchange cons. Travel smart and enjoy your adventure.

Download the Palremit app on Google PlayStore or Apple Store to enjoy seamless financial transactions on the go. The app now allows you to swap money between USDT and other local currencies, so you can start using your money without borders.