Why Many Africans Abroad Still Struggle Financially (Even When They Earn Enough)

Why Many Africans Abroad Still Struggle Financially (Even When They Earn Enough)

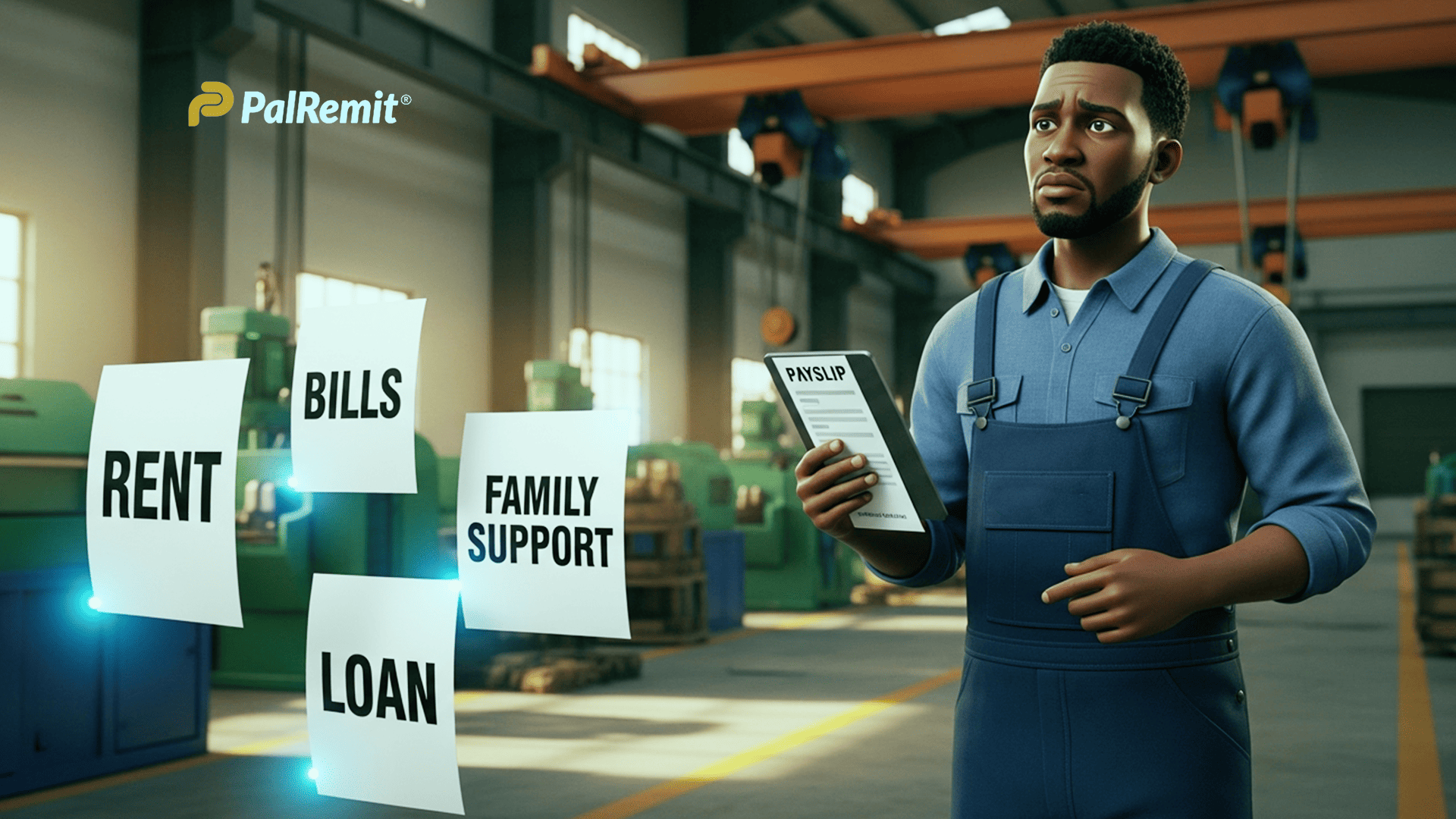

Africans in the diaspora are earning more than ever. Yet many still find themselves living from paycheck to paycheck.

The problem is not always income. It is the invisible costs, expectations, and quiet emotional pressures that come with “making it abroad.”

When you live abroad, people back home see the beautiful buildings, the clean roads, the plates of neatly served meals, and the soft glow of your photos.

From the outside, it looks like happiness.

What they don’t see are the quiet nights of budgeting, the silent worries about bills, and the exhaustion that comes from trying to look “okay” all the time.

They do not see the nights you stare at your bank app, wondering how a good salary can still leave you with nothing to save at the end of the month.

“You’re in the Abroad… So How Come You’re Still Broke?”

Chika earns £3,200 a month in Manchester.

Her friends back home call her ajebo. Her mum introduces her as “my daughter in the U.K.” But by the third week of every month, her balance dips below £200.

It’s not because she’s careless.

She works hard, budgets when she can, and even skips dinners out. But between rent, taxes, remittances, and the quiet pressure to “show you’re doing well,” her income slips through her fingers like water.

This is the quiet truth for thousands of Africans abroad. You can earn more and still feel broke.

The Hidden Price Tag of “Making It” Abroad

On paper, relocation looks like a golden ticket. In reality, it comes with invisible costs that slowly chip away at your financial confidence.

- That Monthly Transfer That Feels Like a Love Letter (and a Burden)

Sending money home isn’t just about support. It’s emotional. It’s how we say “I’m still here for you.”

But that love, multiplied by bad rates and hidden fees, often eats into your peace of mind.

“I send £150 every month to my mum,” a friend once said. “But by the time it hits her account, it’s barely ₦210,000. The rates are killing me.”

- Family Expectations That Never Pause

Once you leave, you automatically become “the provider.” Even when you’re stretched thin, saying no feels like betrayal. And explaining the cost of living abroad often sounds like an excuse.

- The Hidden Costs No One Warned You About

Taxes. Healthcare. Internet. Insurance. Even air feels expensive sometimes

You realize quickly that “abroad money” doesn’t stretch the way it looks from home.

It’s Not Just About Money. It’s About Emotion.

Financial pressure abroad isn’t only about numbers. It’s about identity.

It’s the guilt of saying “not this month.” The fear of being seen as stingy. The shame of struggling in a country everyone thinks is paved with gold.

“You’re not just earning for yourself,” my cousin once said. “You’re earning for the story everyone expects you to live

But Something Is Beginning to Shift

Across the diaspora, a quiet change is starting to take shape. Africans abroad are slowly learning that financial peace doesn’t come from earning more, but from managing differently.

It’s not an easy transition. The guilt, the expectations, the emotional weight of remittances do not disappear overnight. But bit by bit, people are finding better ways to give, save, and support.

-

Learning That Love Needs Boundaries Too We’re learning it’s okay to pause before sending money out of obligation. It’s okay to say “not this month” without guilt. Budgeting and saving aren’t signs of stinginess. They’re signs of wisdom

-

Finding Tools That Actually Help For many Africans abroad, apps like Palremit have become game changer. It is more than just an app. It is a digital wallet that helps you send, swap, and manage money easily. A tool built to make your financial life abroad a little lighter.

Knowing your family gets what they need, when they need it, without you losing half your income to fees or poor exchange rates

- Taking Small Steps Toward True Freedom Financial stability isn’t instant. It’s built through small, consistent habits that make your money work harder for you and the people you love

Also, Financial peace for Africans abroad starts with a mindset shift.

One that says;

-

I can support my family without draining myself.

-

I can enjoy life abroad without living paycheck to paycheck.

-

I can send money home with honesty, not guilt.

Because money should move with purpose, not pressure.

Maybe “Making It Abroad” Isn’t About Money After All

Maybe it’s about peace. About learning to give from overflow, not from exhaustion. About building systems that support you as much as you support others.

Because at the end of the day, every transfer tells a story. And with the right tools, that story doesn’t have to be one of struggle.