In Nigeria today, your debit card is less of a key and more of a locked gate; for many, that gate stays closed. Despite living in an increasingly digital world, millions of Nigerians are unable to pay for the platforms they rely on. Whether for work, education, or everyday convenience. The issue so far has proven not to be a lack of funds. It is the growing disparity between the traditional banking system and the global market.

Most banks have heavily restricted local naira cards. In recent years, international spending limits were slashed to as low as $20 per month, and in many cases, blocked entirely. Even dollar cards linked to domiciliary accounts offer no guarantee. They often require branch visits, foreign currency deposits, and still fail on International platforms.

This makes simple tasks like renewing a Netflix subscription, topping up iCloud storage, or paying for Apple Music needlessly complicated.

Whether you are a freelancer running ads for a client or a student paying for an online course, international payment issues have become increasingly common for Nigerians.

This guide explores why traditional dollar payment methods fall short, how virtual dollar cards work, and what a better alternative looks like for Nigerians who want global access without stress.

Why Traditional Dollar Payment Methods Fail in Nigeria

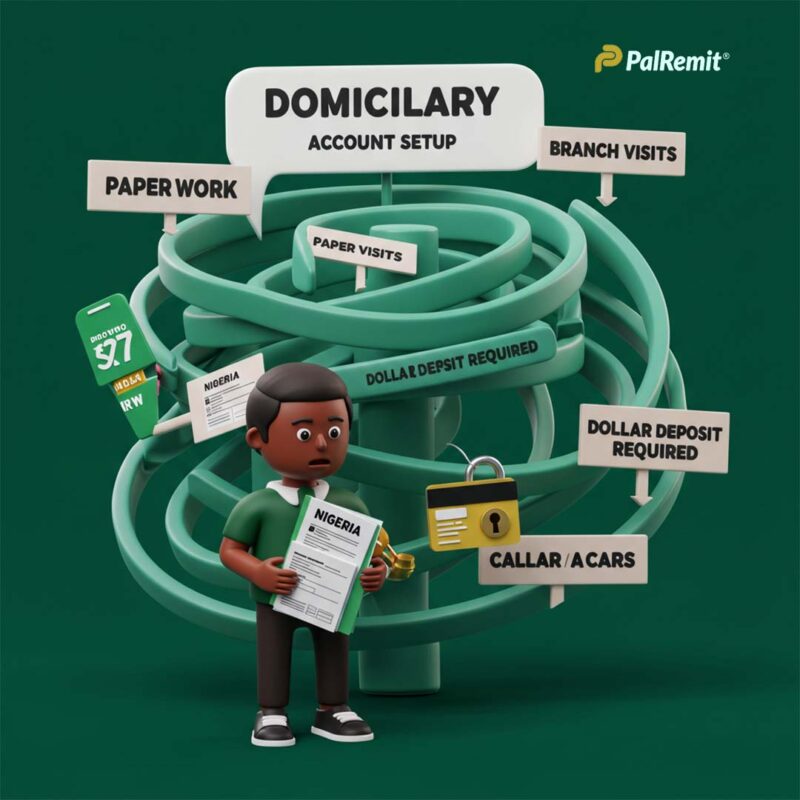

Many Nigerians assume the answer is to open a domiciliary account or apply for a bank-issued dollar card. In theory, this ought to solve the problem, but in practice, it creates new ones.

Domiciliary accounts are not designed for ease. Setting one up typically involves paperwork, multiple branch visits, and in some cases, an initial dollar deposit. Funding the account is another challenge. Most banks only accept FX inflows from abroad or cash dollar deposits, both of which are increasingly difficult for the average user to access.

Even after navigating that process, functionality is not guaranteed. Bank-issued dollar cards may come with lengthy processing times, usage restrictions on specific platforms, rejections during international transactions, or ongoing maintenance fees. In the end, you are left with a product that was supposed to simplify global payments but often causes more frustrations.

Accessing global services should not require insider workarounds or foreign connections. It should feel instant, flexible, and built for the digital economy.

That is where virtual dollar cards come in.

A Better Way to Pay for International Services from Nigeria

The problem is not just about access. It is about ease. Dollar-based payments in Nigeria are limited and inconvenient, and virtual dollar cards shift the conversation from what should work to what actually works.

Virtual dollar cards are digital prepaid cards denominated in United States dollars. They are created and used entirely online and come equipped with the same features as a physical debit card: a 16-digit number, expiry date, and CVV. These cards are accepted across most platforms that support international payments, including app stores, streaming services, productivity tools, and ad platforms.

Unlike traditional banking solutions, virtual dollar cards do not require a domiciliary account, foreign currency deposits, or even physical documentation. They are built for speed, flexibility, and real-world use.

Palremit is one of the platforms enabling this shift. With fully digital onboarding and multiple funding options, including naira, cryptocurrency, and existing dollar balances, Palremit allows users to generate a virtual USD card within minutes. After completing a short identity verification, users can fund their wallet and instantly receive a card ready to be used across global platforms.

How to Get a Virtual Dollar Card in Nigeria

Setting up a virtual dollar card through Palremit is a straightforward process. It does not require a domiciliary account or a physical visit to a bank. Everything is handled digitally, and most users complete the steps in under ten minutes.

Step 1: Create a Palremit Account

Visit palremit and register with your email address. After creating an account, complete your Know Your Customer (KYC) verification using your BVN and a valid ID (National ID card, driver’s license, or international passport).

Step 2: Fund Your Wallet

Once verified, fund your Palremit wallet through any of the following:

- Naira via local bank transfer

- Cryptocurrency (Bitcoin or USDT)

- USD from an existing balance

Your funds will be automatically converted to USD at a transparent exchange rate displayed on the platform.

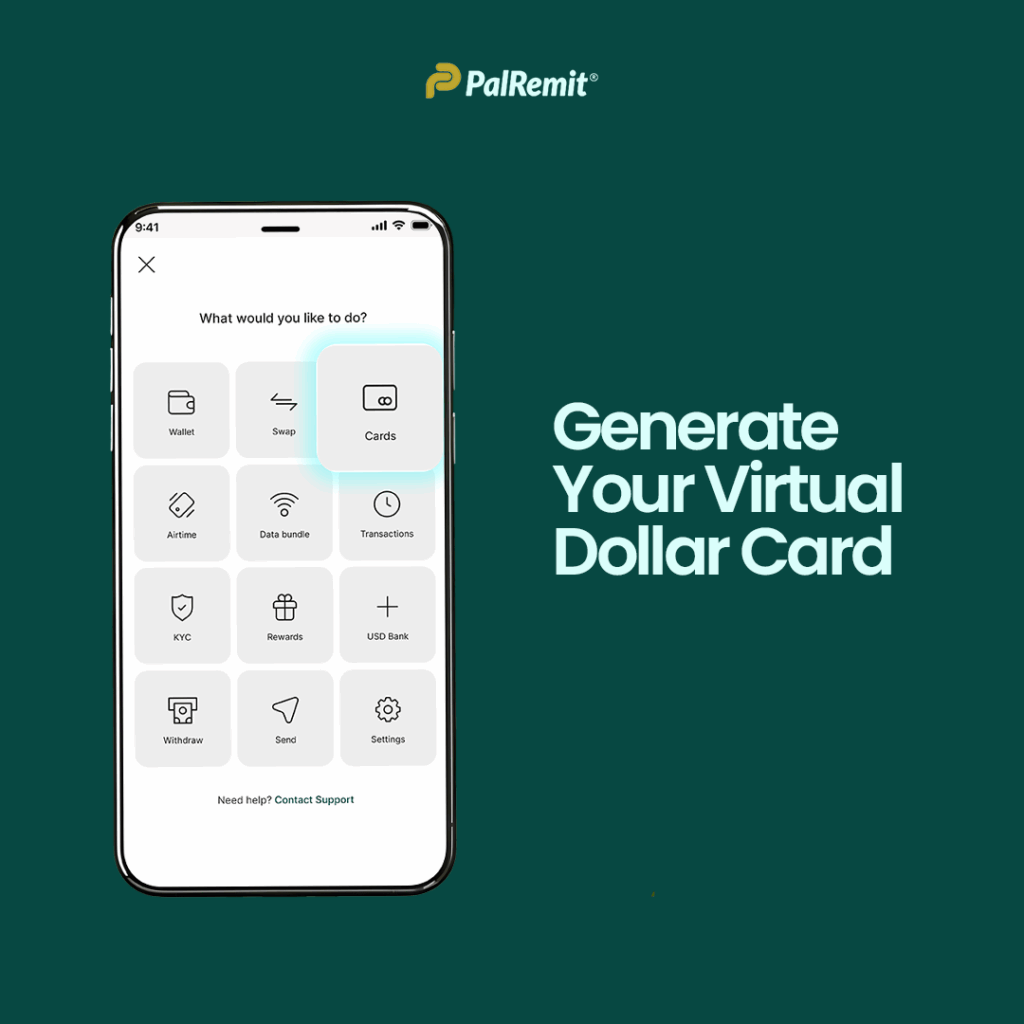

Step 3: Generate Your Virtual Dollar Card

Within your dashboard, go to the “Cards” section and click to create a virtual dollar card. You will receive:

- A 16-digit card number

- A CVV code

- An expiry date

This card functions just like any international debit card.

Step 4: Start Making Payments

Your card is ready immediately after funding. Use it to pay on platforms like:

Digital services: Meta Ads, Google Ads, ChatGPT

Streaming services: Netflix, Spotify, Apple Music

App stores: Google Play, Apple App Store

Productivity tools: Grammarly, Canva, Adobe

Conclusion: The Locked Gate No Longer Needs a Key

For many Nigerians, the challenge of paying for global services has never been about a lack of money. It has always been about access. Traditional banks have not kept pace with the realities of a digital, borderless economy. Their systems remain rigid, slow, and often unreliable, especially for those who live and work online.

Virtual dollar cards are not just a workaround. They represent a smarter, more dependable way forward. With platforms like Palremit, users can finally step outside the limitations of paperwork, branch visits, and unpredictable payment blocks.

Now the question is no longer whether you can pay.

It is when you will begin.

Virtual dollar cards have removed the barrier. The next move belongs to you.